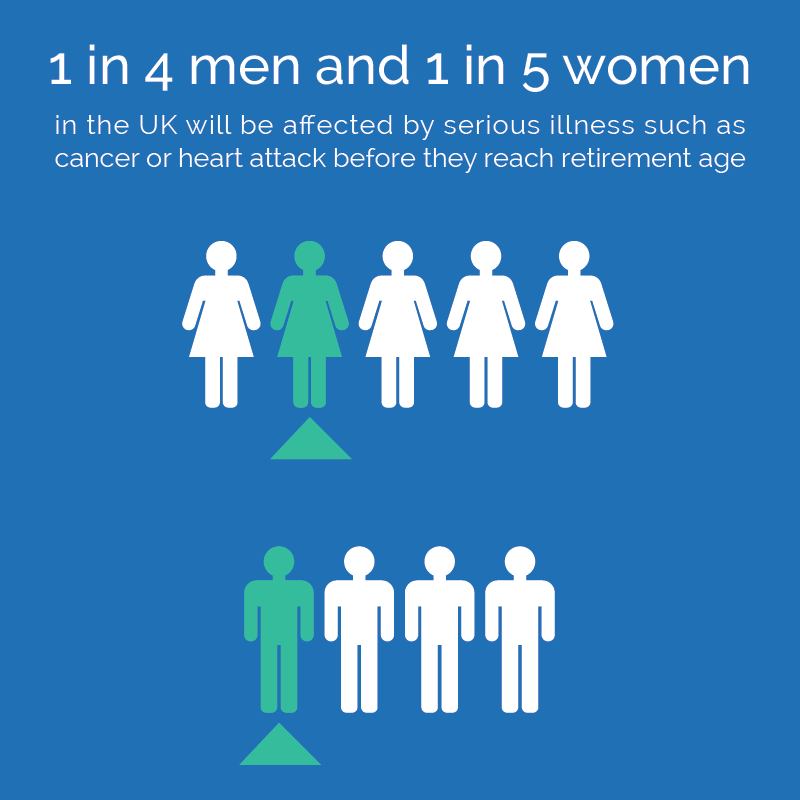

Critical illness insurance provides you with a lump sum of money if you are diagnosed with certain illnesses or disabilities.

The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke, loss of arms or legs, or diseases like cancer, multiple sclerosis or Parkinson’s disease.

If being ill has left you out of pocket, it can be really handy to have a large sum of money to spend on things like everyday expenses, paying off your mortgage or your medical expenses. You can use the money in any way you like, you don’t have to spend it on anything in particular.

You may have other income coming in while you’re ill such as state benefits or sick pay from your employer. However, this may not cover all your needs. It’s a good idea to think about how much you would need to live on if you became seriously ill and whether you would need some extra money to boost your income.

There are other types of illness insurance you can take out such as income protection insurance. Critical illness tends to be a less expensive way to protect your income against illness and disability but it does have some drawbacks and limitations.

You should compare critical illness with other types of illness insurance before you decide to buy it.

What you need to think about before you take out critical illness insurance

Before you think about taking out critical illness insurance, ask yourself the following questions:

Do I really need critical illness insurance?

Check the following:

- whether you already have some illness insurance combined with another insurance policy like a life insurance policy, or with your mortgage which covers you for serious illness

- what benefits your employer pays out if you can’t work because of ill-health or disability

- whether you have savings you can use instead of insurance.

Is this the best type of illness insurance for me?

Check out all the different types of illness insurance to see which one would suit you best. For example, income protection insurance usually includes a greater range of illnesses and conditions than critical illness insurance and may cover you for a longer period time if you can’t work. However, it will probably cost you more than critical illness insurance.

For more information about income protection insurance, see Income protection insurance.

Do you have enough money to pay for illness insurance?

The costs (or premiums) of critical Illness insurance can be quite high and you may never need to use it. You won’t get any money back if you never make a claim.

Are there any exclusions?

Critical illness insurance policies don’t cover every type of illness. And with the illnesses they do cover, you usually have to be extremely ill or totally disabled before you can claim.

On top of this, you may not be covered for certain illnesses which either you or a member of your family has had before.

You will need to check the insurance policy carefully to see what it will pay out if you become ill.

What you need to know before you take out critical illness insurance

You will need to know exactly how much you’ll get if you make a claim. When you make a claim on a critical illness insurance policy, you will only get one payment. This could be a very large sum of money, depending on how much you have chosen to insure yourself for. However, it may not last if you are unable to work for a very long time, or may never work again. On the other hand, income protection insurance can last for as long as you need it.

For more information about income protection insurance, see Income protection insurance.

You will need to know exactly which illnesses are covered by the policy. Only a certain number of very specific illnesses will be covered. Check the insurance policy documents very carefully to make sure you know which ones. There are rules which say the policy documents must be written in easy-to-read plain English, so you can understand what you will be covered for.

You will need to know exactly how severely disabled or ill you must be before you can make a claim. For example, some early stages of common cancers probably won’t be included, or you may have to be totally disabled before you will get any money.

You will need to know if existing medical conditions are covered. These are illnesses that you’ve had before. Insurers will look at your family medical history and some policies will cover existing medical conditions but others will not. If your family medical history means that there will be conditions attached to you taking out the policy, your insurer should explain these to you before you sign up for the policy.

What you must tell your insurer before you take out critical illness insurance

You must give your insurer full details of you and your family’s medical history. If you leave anything out and then later try to make a claim, your insurer may refuse to pay out.

If you already have a pre-existing medical condition, look for an insurer that will be prepared to cover it, although you may have to pay more to take out the policy. A pre-existing medical condition is one you’ve had before.

You don’t have to discuss personal or sensitive information with the person who sells you the policy. You can ask to send the information directly to the insurer’s medical officer.

How critical illness insurance costs

The costs of taking out critical illness insurance vary from person to person and are affected by your:

age – the older you are when you take out the policy, the more you are likely to pay, as your risk of getting ill increases

sex – men make slightly more claims than women, so may pay more

health – if you’re in good health you will pay less to insure yourself

job – if you do a risky job, you will pay more for cover

hobbies and lifestyle – if you take part in dangerous hobbies, or you smoke, for example, you will pay more for cover

Would you like to know more?

If you have any questions, would like to know more or get help from our award winning team call 0151 459 2912, email info@bluestrawberryfinancialservices.co.uk or click here to book an appointment.

MORE ARTICLES

Questions all buyers should ask

Mark Pollard2022-04-21T13:08:13+01:0021 April 2022|

What is Critical Illness Cover?

Mark Pollard2022-03-22T16:22:07+00:0022 March 2022|

Porting, Assuming, or Breaking A Mortgage: What You Need to Know

Mark Pollard2022-02-15T16:05:00+00:0015 February 2022|