What is Life Assurance?

Life insurance and life assurance are easily confused, and while the former is perhaps better known, what exactly is a life assurance policy? In this article we’ll explain the nuances between these terms.

Life assurance can be another way of describing a ‘whole of life’ policy. An insurer may refer to life assurance, meaning the cover is indefinite, with no fixed expiry date, unlike a life insurance policy term. The word ‘assurance’ is used because you’re assured that a valid claim will be paid regardless of when you die, so long as you pay your premiums.

What are the differences?

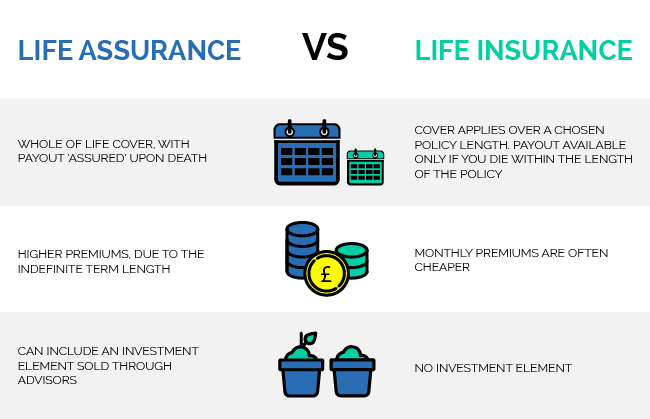

Here are the differences at a glance between life assurance and life insurance:

Life assurance

- Whole-of-life cover, with a payout ‘assured’, upon death.

- Higher premiums, due to the indefinite term length, the provider expects to pay a valid claim.

- These policies sometimes include an investment element and are sold through advisers.

Life insurance

- Cover applies over a chosen policy length.

- Payout available only if you die within the length of the policy.

- Monthly premiums are often cheaper.

These definitions are intended to be a rule of thumb, so make sure you have all the information you need before you decide whether a policy meets your needs.

How does a life assurance policy or whole of life policy work?

Life assurance policies offer insurance cover for the whole of your life, rather than a chosen policy length. A life assurance payout is tax-free, and provided the premiums have been paid, a claim can be made upon the death of the insured person. You’ll have the advantage of guaranteed cover for as long as you need it, but the reality is you’ll pay higher premiums for the privilege.

Who is life assurance for?

These policies are most commonly used in Inheritance Tax planning. If you’re interested in whole-of-life cover, it’s worth speaking to a financial adviser to find out if this is the right type of protection for you.

What type of policy should I choose?

Everyone’s circumstances are different, but for a lot of people, life insurance provides the right level of cover with the most affordable premiums. Many of the key chapters of your life have a defined length of time, from a child finishing school to paying off a mortgage, and the benefit of term life insurance is that you can choose the amount of cover you need, and how long you’ll need it for. While life assurance can meet all these needs you’ll pay higher monthly premiums for an equivalent level of cover.

Would you like to know more?

If you have any questions, would like to know more or get help from our award winning team call 0151 459 2912, email info@bluestrawberryfinancialservices.co.uk or click here to book an appointment.

MORE ARTICLES

Questions all buyers should ask

Mark Pollard2022-04-21T13:08:13+01:0021 April 2022|

What is Critical Illness Cover?

Mark Pollard2022-03-22T16:22:07+00:0022 March 2022|

Porting, Assuming, or Breaking A Mortgage: What You Need to Know

Mark Pollard2022-02-15T16:05:00+00:0015 February 2022|